By Jill Winsor

On Tuesday, June 1 3th, we were joined by a group of the best and brightest leaders and thinkers from Linn, Benton and Lincoln Counties. The Regional Asset Building Summit took a close look at the economic forces in the area, the impacts those forces are having on lives of families and innovative ways we can improve community financial well-being. Here are our biggest take-aways.

3th, we were joined by a group of the best and brightest leaders and thinkers from Linn, Benton and Lincoln Counties. The Regional Asset Building Summit took a close look at the economic forces in the area, the impacts those forces are having on lives of families and innovative ways we can improve community financial well-being. Here are our biggest take-aways.

1. Housing affordability is just as difficult an issue in the region as it is in other communities across the state.

Regional Economist, Pat O’Connor, shared data on how hard it is for families with very low incomes to find affordable housing.

- In Linn county there are only 15 affordable units available for every 100 families with extremely low incomes.

- In Benton there are only 14 affordable units.

- By comparison, Lincoln county is doing better with 34 affordable units for every 100 families but we know this still leaves far too many families without access to a safe place to call home.

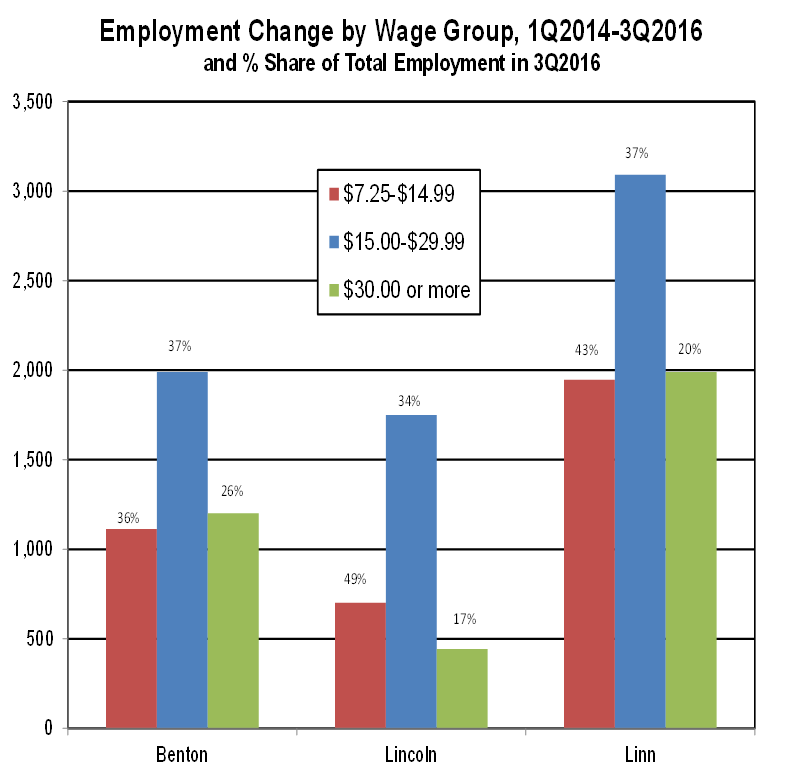

2. Although average wage in the region has not kept pace with the nation, since 2014 all three counties have seen strong middle wage job growth!

3. Individuals experiencing the scarcity caused by having inadequate financial resources make decisions based on the limited options they are able to see in front of them. We can make sure those are good options and design our programs to support good choices and we have great local examples!

We can design our programs to cut the costs for participants, for example, by literally meeting clients where they are and bringing our services into the spaces our clients already occupy. NEDCO (Neighborhood Economic Development Corporation) is doing just that with their employer-based financial education services. NEDCO is partnering with local employers to provide financial education and coaching at worksites at times that are convenient for workers.

Willamette Neighborhood Housing provides a full spectrum of financial tools to their clients, including “Dollars and Sense” workshops and intensive coaching to reach homeownership goals. They are doing amazing work to reframe their services to draw on the incredible resilience and wealth of understanding their clients bring to the table. Treating their clients as experts shows immense respect for the communities they are engaging and allows for a more impactful relationship.

Automatic enrollment and opt-out design means that we can make the “right choice” the “easy choice.” The Oregon Asset Building Coalition is using that idea in their work to design a Children’s Savings Account platform that will automatically open a long-term, incentivized savings account for each and every child born in Oregon. This will make it easier for families to take action to start to save for their children’s future education.

4. Linn, Benton, and Lincoln Counties have an amazing set of thinkers and leaders ready to dig in and identify new solutions to increase financial well-being in the region!

We heard some great ideas from everyone who came, and a lot of interest in coordinating and communicating to maximize everyone’s impact. Some ideas:

- Joining the financial capability conversations with conversations about health equity

- Matched savings programs for kids in schools

- Make sure we are all talking about the 8 Dimensions of Wellness: emotional, spiritual, environmental, physical, financial, intellectual, social and occupational

- Create a summer or first jobs program that incorporates matched savings and financial capability

5. We are all eager to keep this conversation going!

Folks stuck around after the end of the event to keep talking and we heard from a handful of attendees that they want more opportunities to connect in. We are happy to oblige, check out these opportunities and resources!

- Join us in Portland on July 19th for Asset Builders Unite! A gathering for asset builders and financial capability providers to talk about what’s happening in their communities and share best practices. Learn more and register here.

- Spend two whole days with Oregon’s affordable housing and asset building communities at the annual RE:Conference. Learn more here.

- For further reading and exploration, we’ve compiled a resource sheet – check it out here.

- If you want a Your Money, Your Goals or Building Financial Capability training, please email me! jwinsor@neighborhoodpartnerships.org

- If you want a Regional Asset Building Summit in your community, please email me! (jwinsor@neighborhoodpartnerships.org)

Thanks to our incredible planning committee –

- Bill Hall, Lincoln County Commissioner

- Bill Humphreys, Citizens Bank

- Brigetta Olson, Willamette Neighborhood Housing

- Emily Reiman, NEDCO

- Fred Abousleman, Oregon Cascades West Council of Governments

- Heather DeSart, Oregon Northwest Workforce Investment Board

- Martha Lyon, Community Services Consortium

- Patrick O’Connor, Regional Economist, Oregon Employment Department

- Stacie Wyss-Schoenborn, Central Willamette Community Credit Union

Thanks to JP Morgan Chase and NW Natural for their generous support of this work.