By Jill Winsor

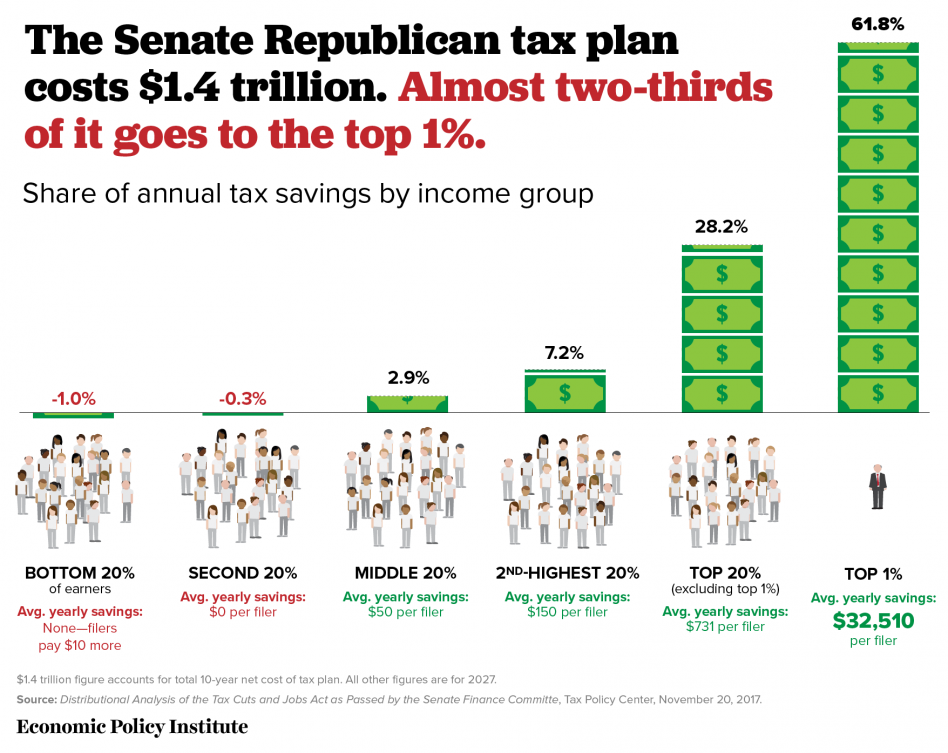

Image taken from this Economic Policy Institute article.

The US House of Representatives and US Senate have both passed versions of a tax bill that have serious implications for hard working Oregonians. We need a tax system that supports our neighbors and community members. The tax proposals on the table are upside down – they greatly benefit corporations and extremely wealthy people, and hurt children, families, seniors, students and our communities at large. Today, the conference committee begins their work to reconcile the two versions, there is still time to weigh in with our Congressional representatives, and ask that they turn this tax proposal right-side-up!

Here is a highlight of our biggest concerns:

- This tax plan will deepen already enormous income inequality.

- This tax plan will likely trigger cuts to some of our most important programs including Medicare and Social Security.

- The House version eliminates several deductions and credits that benefit hard working people.

- This tax plan will dramatically and negatively impact our ability to build affordable homes across Oregon and the US.

As this bill heads into conference committee, it’s important to remember that we still have opportunities to make our voices heard, and to help turn this plan right-side-up. We can use the tax code to invest in opportunity for communities, families, and individuals.

Have you contacted your members of the House of Representatives and the Senate yet?