By Jill Winsor

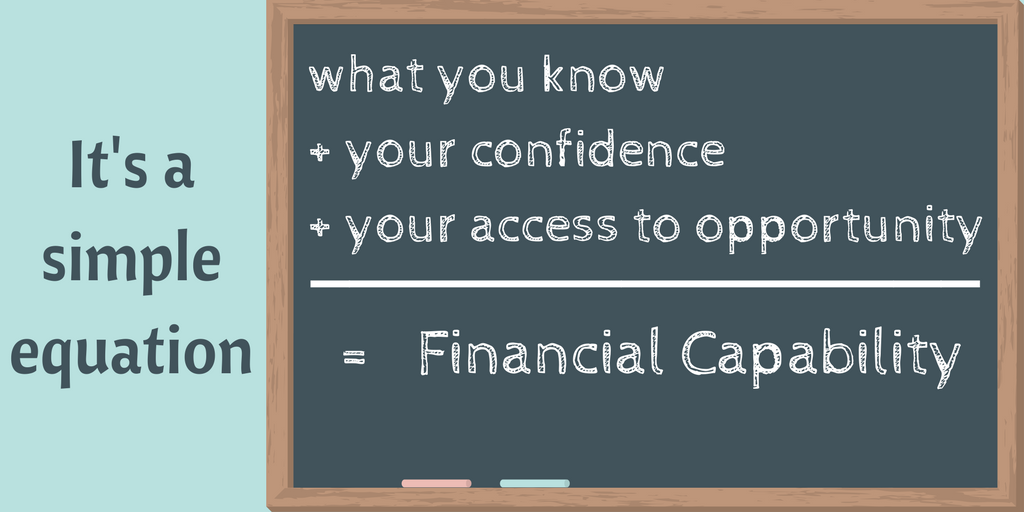

April is Financial Capability Month. We here at NP will be celebrating all month long. Financial capability is defined as “the capacity, based on knowledge, skills and access, to manage financial resources effectively.[1]” Here at Neighborhood Partnerships, we think of financial capability as an equation:

We track research and new learnings in this arena and work hard to share information with our network because we know how important it is to be ever innovative. As Maya Angelou said, “Do the best you can until you know better. Then when you know better, do better.”

With that in mind . . .

The Common Cents Lab, a behavioral economics research team, recently conducted a survey of 800 American households and found that over a third reported having less than $800 in savings – including retirement savings. Remarkably, 92% of survey participants could list three or more actions they could take in the next month to improve their financial well-being.

What does this tell us? There is a difference between knowing something and taking action on that knowledge. Financial literacy is only one element of the financial capability equation. We need to find better ways to increase confidence, build habits, and on ramps to opportunity!

The three-piece framework shared by Common Cents Lab suggests some next steps for how we support improved financial behaviors, reduce barriers, and increase the benefits of taking specific actions.

Behavior

In our financial capability programs, we need to make sure that the behaviors we want participants to engage in are measureable and actionable. It’s not enough to say the desired behavior is “paying down debt.” Get specific! A measureable and actionable desired behavior would be “pay $10 more than the minimum payment each month.” Take that a step further by identifying when that payment is due and helping participants set a calendar reminder.

Research has also shown that programs that ask participants to set just one savings goal rather than many savings goals have higher success and savers are more likely to increase their overall savings.

Barriers

Common Cents Lab digs into barriers at an incredibly granular level. Every click, every field, every signature, every step, every call, every choice, every form a participant engages with might be a barrier and we should take action to reduce and automate as much as we can.

If your desired behavior change is that participants improve their credit score 100 points in 6 months, during your coaching session or classroom workshop, give participants the opportunity to log into a free credit check service and see their score in that moment. Or, just texting someone their credit score (instead of requiring them to log in) has been shown to be an effective way to support people in their goal of improving their credit score.

Further, Common Cents Lab encourages programs to limit our financial education sessions or coaching sessions to just one hour. The effects of coaching and training wear off after an hour because our attention span and cognitive ability to retain info depletes after that amount of time. If your session is longer than an hour, build in breaks and build in different types of learning activities.

Benefits

Our programs need to provide a benefit that is present-moment focused and emotionally charged. How do we make taking action for our future selves (retirement savings, children’s savings accounts) attractive in this moment?

Research has shown the efficacy of having participants envision their future selves for five minutes and then giving them the immediate opportunity to take action. For example, encourage participants to envision life in a worry-free retirement and then immediately give them an opportunity to increase their contribution to their Oregon Saves retirement account.

Social proof is another excellent way to increase the benefits of a behavior or action. Financial coaching is effective because of the level of accountability built into that one-on-one relationship. It’s easier to complete a task when you know it will feel embarrassing to show up empty handed to your next coaching session.

Share your stories?

How are your programs defining the behaviors you want to change? How are you measuring them? Have you mapped out each and every step a participant must take to engage with your program? Where can you automate? How do you build in social proof and make the future tangible for your participants? We know our incredible network of partners are already innovating in these realms and would love to hear your examples. Reach out and let us know what you are up to! jwinsor@neighborhoodpartnerships.org

[1] As defined by US Dept. of Treasury. Retrieved from: https://www.treasury.gov/resource-center/financial-education/Documents/PACFC%202010%20Amended%20Charter.pdf