How two Oregon nonprofit employees are taking the practical science of behavioral economics and making it work for them.

By Matt Kinshella

Let me tell you a story about how a tiny decision made by public officials has saved millions of lives in several European countries. And how understanding the science behind that change has helped two Oregonians bring financial stability to their clients.

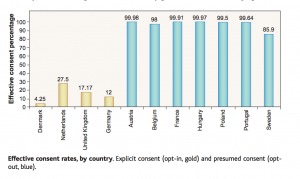

Below is a plot of the percent of people in countries who have signed up to donate their organs after death.

You’ll notice in Austria, Belgium and France nearly 100% of people sign up to donate organs. You’ll also notice that Germany, the UK and the Netherlands have a much lower rate of participation.

Why is it that some countries have such success at getting citizens to donate organs and others have such little success? Is it a factor of culture, religion or history? If so, how could countries we perceive to be relatively similar, like Germany and Austria, have such widely different results?

Public officials in the countries on the left asked themselves this very question. They figured it had to be that their more successful organ donation counterparts had better informed populaces. So they embarked on very expensive public education campaigns to highlight the societal benefits of organ donation. But those efforts had almost no effect.

The group on the right didn’t have better informed people. The explanation was much more simple than that.

It came down to the way a motor vehicle department form in each of these countries was designed.

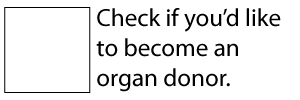

In places with low donor rates, residents have to decide to participate in the donor program by checking a box. Like this:

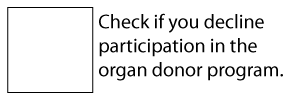

In places with high participation rates, people are already opted in to the donor program, but they can check a box to decide not to participate. Like this:

Having people decide to participate – weighing the pros and cons – takes conscious thought and emotion, which is taxing. On the other hand, having people just go with the flow and participate in something they are already enrolled in is easy.

Eric J. Johnson and Daniel Goldstein’s seminal organ donor study is one of the most popular examples of decision architecture in the burgeoning field of behavioral economics.

Behavioral economic studies show how our environment (like the forms we interact with), our emotions and a host of other factors that are not at all intuitive influence our behavior. Often times, making small changes has a much bigger impact than we may intuitively think. Imagine if I had showed you those two box options before the research. You may have understood it would make a difference, but you probably wouldn’t have guessed it would make that big of a difference.

In Oregon, several organizations are putting the best of behavioral economics to the test in programs designed to get people more financially healthy. They are making these small changes that are often very inexpensive with the hopes of yielding big rewards. And they want to share some of their secrets.

Behavioral Economics in Oregon

Two people doing using behavioral economics in Oregon are Molly McGlone from Reach CDC and Cassie Russell from Bradley Angle. I asked them what some of their favorite behavioral economics examples are and how it is shaping their work. You can also hear from them, and yours truly, at 2:00 pm on Oct. 30 at the Neighborhood Partnerships’ RE: Conference.

Molly McGlone, Reach CDC

Molly has been heavily influenced by the “Behavioral Economics in Action” class from University of Toronto (It’s being offered again this fall, by the way).

This free online class covers big picture behavioral economics ideas, research studies and implementation ideas. There are lots of videos, some interactive learning modules and some reading (such as the Practitioner’s Guide to Nudging)

Molly and Reach CDC have “stolen” some of the concepts and ideas in the course and teach related activities in their financial education class (such as mental accounting, choice/information overload, and social proof).

They have also used the “mapping the context” process described in the “Practitioners Guide to Nudging” to identify common bottlenecks in their IDA program processes. They have been experimenting different “nudges” to resolve these bottlenecks.

“For example, in the past residents would express interest in our program and be invited to an upcoming info session that could be weeks or over a month later,” says Molly. “Now we strive to meet in-person with residents who express interest within one week, to encourage their forward momentum and use relationship-building to solidify their commitment.”

Scarcity by Sendhil Mullainathan and Eldar Shafir has been instrumental in Molly and Cassie’s work (The same goes for us at NP. We even have a signed copy!)

“We teach the concepts of limited bandwidth and the impact of environmental conditions in our financial education class and have a couple activities connected to these issues,” says Molly.

Reach CDC is currently considering how they could make some bigger changes to program processes to respect the bandwidth tax issue. For instance, they are exploring how to offer matched-savings or credit-building options through opt-out choice, rather than opt-in, for example.

Lastly, Molly says they use The Power of Habit by Charles Duhigg as a model:

“We teach the concept of the “habit loop” in our class and use the “Money Habitudes” solitaire activity (http://www.moneyhabitudes.com/) to explore participants’ current habits and attitudes and set intentions for changing routines.”

Cassie Russell, Bradley Angle

“The resource I use most often is ideas42 — they have some great information on their site,” says Cassie Russell Bradley Angle’s Economic Empowerment Coordinator.

In addition to the resources Molly mentioned, Cassie finds two resources from CFED helpful. One covers the basics of behavioral economics really well and the other is a treasure trove of resources.

I asked Cassie how she’s putting her knowledge to work. She mentioned four main areas of behavioral economics.

1) Choice Overload

“Since we know too many choices can be overwhelming we recently reduced our matched savings account offerings. This might sound like a bad thing, but really we just simplified the forms and reduced the number of products offered. This makes it much easier for someone to call and say, ‘I want to do that savings thing.’”

Barry Schwartz’s The Paradox of Choice makes an argument for Cassie’s efforts. In it, Schwartz says too many decisions induce more stress than happiness.

2) Procrastination

Cassie recognizes that program participants mean well. They intend to make deposits into their savings accounts at the end of the month, but life has a way of interrupting. By asking savers to make deposits on the 25th of the month, they’re able to help people avoid procrastination.

3) Limited Attention

“I’m writing this with a phone on my shoulder, while messaging three colleagues,” Cassie admits. “We all experience limited attention on a daily basis. At Bradley Angle, we know that in addition to the limited attention we all face, survivors also face trauma. We try to remedy limited attention by providing on-site childcare, meals, and bus tickets. This eliminates three big things most people would have to coordinate in order to come to a meeting, and provides them with some of what they need in order to be present during meetings.”

4) Loss Aversion

Another cornerstone finding in behavioral economics is loss aversion.

“Losses hurt us more than wins help us,” says Cassie. “When framing our matched savings and credit building programs we highlight what could be lost by not participating.”

In that spirit, behavioral economics is one of the most exciting fields today. Its applications are widely applicable and often very cheap to implement. Anyone interested in program design or communications is missing out if they aren’t familiar with it. So make sure you don’t miss out.

Learn more about behavioral economics and its applications at the Neighborhood Partnerships’ RE:Conference. You can purchase tickets here.